Let us consider in the form of step-by-step instructions the procedure for registering sick leave in 1C ZUP 8.3.

You will learn:

To register in 1C 8.3 ZUP 3.1 the period of employee illness, two types of documents are used: and Sick leave . The sequence of their use is as follows:

Let's take a closer look at registering and calculating sick leave in the program.

If an employee was (or is still) “on sick leave” and has not yet provided the employer with a certificate of incapacity for work, but at the same time it is time to calculate the salary or advance, then in order for him not to receive a salary for the period of “sick leave”, and also so that days of absence were marked on the report card with a code B, in the 1s 8.3 ZUP program you should enter the document Absence (illness, absenteeism, no-show) with reason . Let's consider how to correctly register such an absence.

So that in the 1C 8.3 ZUP program it is possible to register a document Absence (illness, absenteeism, no-show) in the settings for the composition of charges and deductions ( Settings – Payroll calculation – Setting up the composition of accruals and deductions) on the tab Absence accounting checkbox must be checked Absenteeism and no-shows :

Registration of sick leave that has not yet been “closed” is carried out by document Absence (illness, absenteeism, no-show) ():

If two groups of users work with the 1C ZUP program: HR specialists and payroll accountants, then it is assumed that the document Absence (illness, absenteeism, no-show) Personnel officer, indicating in it the employee and the period of absence, and then the user with the profile Calculator- the document states.

In the document:

Example 1

Gerankin G.G. fell ill on April 10 and notified the employer by phone. By the time the advance payment for the first half of April was calculated, the employee had not yet returned to work and had not provided sick leave.

The absence of an employee is registered using a document Absence (illness, absenteeism, no-show) .

The document should indicate Month– April, since it is when calculating the advance payment for April that this absence should be taken into account.

In this case, the period of absence should be specified as the period from the 10th to the 15th, since the end date of the employee’s illness is not yet known, and the salary will be calculated for the first half of the month - from April 1 to 15, therefore, all absences must be reflected in the database that occurred on April 15th.

If in the example under consideration, the employee does not return by the end of the month and does not provide a certificate of incapacity for work, then an absence for an unclear reason will need to be entered for the period from April 16 to April 30, so that this absence will be taken into account in the final calculation of salaries for April.

Example 2

Employee Kirsanov K.K. fell ill on April 29. By the time the salary for April was calculated (salaries are calculated on May 6), the employee had not yet returned and provided sick leave.

In this case, you also need to enter a document Absence (illness, absenteeism, no-show) for this employee and register absence in April for the period from 29.04 to 30.04:

It is important to choose correctly Month in the document Absence (illness, absenteeism, no-show) . If in the above example you specify Month not April, but May, then when calculating the April salary, the program “will not see” the employee’s absence, and payment will be accrued for the month fully worked.

After a user with a profile Personnel officer document Absence (illness, absenteeism, no-show) , it will be in bold in the document log because it has not yet been approved. To a user with a profile Calculator you should approve the document using the command Approve from the log or by checking the appropriate box in the document itself:

If multi-user work is not configured in the 1C 8.3 ZUP program, then the approval flag in the document form is not displayed; it is considered that the document is approved immediately when the document is posted.

After document approval Absence (illness, absenteeism, no-show) When calculating an employee's salary, the hours worked will be determined taking into account this absence.

Example 1

When calculating the advance for April, the absence of employee Gerankin G.G. will be taken into account. from 10 to 15 April. This period accounts for 7 working days out of the norm of 22 days planned in the employee’s schedule. Therefore, the employee will be paid only for 7 days worked:

Example 2

When calculating salaries for April, the absence of employee K.K. Kirsanov will be taken into account. in the period from 29.04 to 30.04. This period accounts for 2 working days out of 22 normal days for April according to the employee’s schedule. Therefore, for Kirsanov, the calculation will occur only for 20 days worked:

If for an employee the fact of absence due to illness is registered with a document Absence (illness, absenteeism, no-show) with an air of absence Illness (sick leave is not yet closed) , then such periods are automatically reflected in the time sheet with a letter code B :

After the employee provides the form for a certificate of incapacity for work, the document must be registered in the 1C 8.3 ZUP program Sick leave and calculate it.

There is no need to reverse or delete the document Absence (illness, absenteeism, no-show) . The program will automatically replace days of no-show. Also when entering a document Sick leave a warning will be displayed indicating that a document has been entered Absence (illness, absenteeism, no-show) . It is necessary to post the document despite this warning by clicking OK .

Example 1

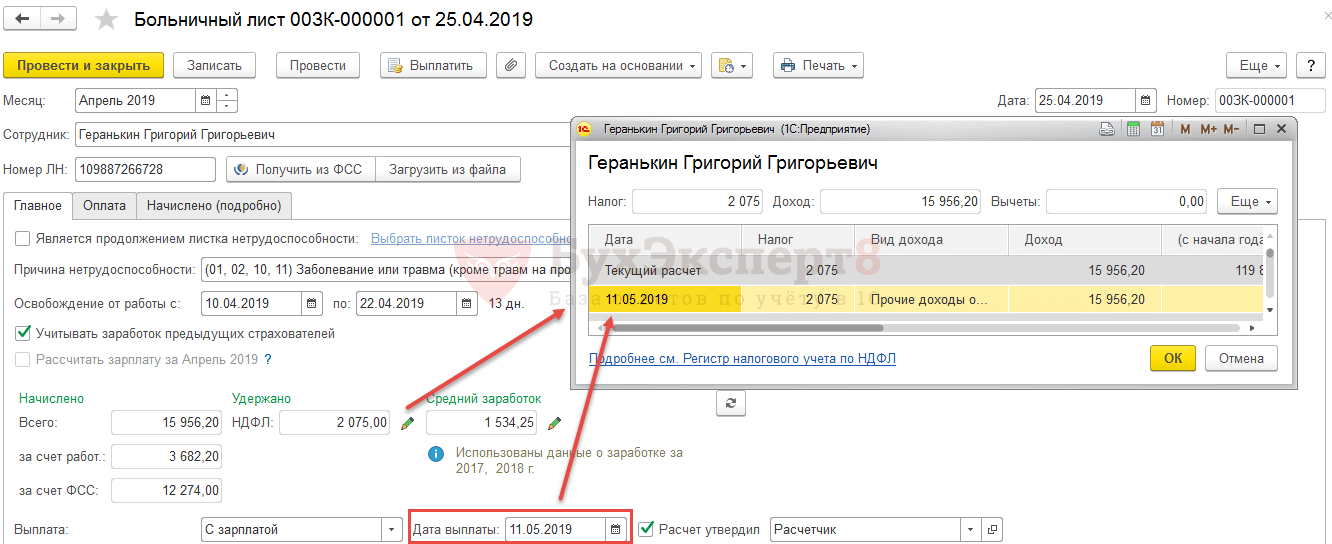

Employee Gerankin G.G. returns to work on April 22 and provides a certificate of incapacity for work. A document was registered on the basis of this sheet Sick leave for the period from 10.04 to 22.04. When conducting, press OK in the warning window.

If sick leave is registered in the next month of accrual in relation to the document Absence (illness, absenteeism, no-show) , then in the document Sick leave Absence for an unknown reason will be canceled explicitly.

Example 2

Employee Kirsanov K.K. returns to work on May 10 and provides a certificate of incapacity for work. By this time, the salary for April has already been calculated and paid. Sick leave for the period from April 29 to May 10 is registered in the accrual month of May:

A tab appears in the document Recalculation of the previous period , which registers the cancellation of the period of absence by type of calculation Absence due to illness (sick leave is not yet closed) .

Confirmation of an employee’s temporary incapacity for work is a certificate of temporary incapacity for work issued by a medical institution. An employee can, at his choice, either receive a certificate of incapacity for work in paper form (on a blue form), or issue electronic sick leave. In the latter case, the medical institution will only inform him of the number of the certificate of incapacity for work, from which the employer can subsequently obtain all the information necessary to calculate the benefit.

To be able to issue electronic sick leave, the employing organization must be connected to the information interaction system with the Social Insurance Fund. Let's look at how to register a paper or electronic certificate of incapacity for work in the 1C 8.3 ZUP 3.1 program.

The certificate of incapacity for work is registered in the 1C ZUP 3.1 program using the document Sick leave (Personnel – All employee absences):

If two groups of users work with the program: HR specialists and payroll accountants, then it is assumed that the document Sick leave entered by a user with a profile Personnel officer, indicating in it the employee and the data from the certificate of incapacity for work, and then the user with the profile Calculator– calculates temporary disability benefits and approves the document. Registration of sick leave is considered for a user with a HR profile.

In the document Sick leave , you must fill in the details correctly Month And date . date is the date of registration of sick leave in the program, and Month– accrual month in which the employee will be accrued benefits according to the document Sick leave .

Example 1

Employee Gerankin G.G. was ill from April 10 to April 22, on April 25 the employee presented the employer with a certificate of temporary incapacity for work. In this case, temporary disability benefits will be accrued to the employee in the April salary, therefore in the details Month month must be specified April. As Dates document indicates the date of registration of the provided sheet in the program, i.e. 25.04 .

Example 2

Employee Kirsanov K.K. I was ill from April 29 to May 10. On May 13, he returned to work and presented a certificate of temporary incapacity for work. In this case, in the props Month should be specified May, since benefits will be calculated on the “May” salary. As Dates The document indicates the date of registration of the provided “sick leave” in the program, i.e. 13.05 .

In props LN number the number of the certificate of incapacity for work is indicated.

If an employee has submitted a paper “sick leave”, the number will be located in the upper right corner of the certificate of incapacity for work:

If an employee has been issued an electronic sick leave certificate, the medical institution will inform him of the number of the certificate of incapacity for work. The number can also be found in the personal account of the insured person or in the personal account of the employer on the FSS website. By number of the certificate of incapacity for work, all data on the electronic sick leave certificate in 1s 8.3 zup can be downloaded automatically - to do this, just click on the button Get data from the FSS or Load from file .

To calculate temporary disability benefits, you need to know the employee's insurance record. Information about the insurance period calculated as of the date of the onset of temporary disability will need to be indicated on the paper “sick leave” in the section To be completed by the employer .

Usually the initial insurance period, i.e. The length of service calculated as of the date of admission is entered into the program when the employee is hired, and in the document Sick leave The insurance period is automatically calculated as of the start date of temporary disability. In this case, no additional actions are required from the user.

If the insurance period for an employee is not entered in the program, then it must be entered for the correct calculation of benefits. In this case, in the form of a document Sick leave the inscription is displayed The length of service is not completed, benefits may be calculated incorrectly :

You should click on this inscription and enter the insurance period.

We entered into 1C the employee’s insurance record as of the date of admission. Where can you now see an employee’s insurance record, calculated as of the date of the start of temporary disability, to fill out the “To be completed by the employer” section of the paper “sick leave”?

Unfortunately, in ZUP 3.1.3 the current insurance period is displayed in the document Sick leave only for user with profile Calculator or Full rights (on the tab Payment). Also, information about length of service is displayed in printed form, but printing this form is also available only to accountants. The 1C developers have written down the desire to display the length of service also for the HR officer, but have not yet implemented it.

User with profile Personnel officer can find out the employee’s insurance length as of any date using a personnel report Employee length of service :

If the field on the certificate of incapacity is filled in Continuation of certificate of incapacity for work No. , then this means that this sick leave is a continuation of another:

In this case, in the document Sick leave in the program you need to check the box and select the document Sick leave , of which this document is a continuation.

In this case, first the document is entered into 1C Sick leave for the period from 16.04 to 22.04:

Then the second document is entered Sick leave , in which the checkbox is checked Is a continuation of the certificate of incapacity for work , a link to the first one is indicated Sick leave: and the period corresponding to the second certificate of incapacity for work is entered , i.e. in this case from 23.04 to 30.04:

In props Cause of disability the reason for the disability is indicated based on the code filled in the corresponding cells of the certificate of incapacity for work:

A breakdown of the cause of disability codes is presented on the back of the form:

Employee Gerankin G.G. provided a certificate of incapacity for work, which indicated the code of the reason for incapacity for work - 01 .

In the document Sick leave based on this, the cause of disability is indicated - (01, 02, 10, 11) Illness or injury (except work-related injuries):

If one of the following codes is indicated on the certificate of incapacity for work: 09 , 12 , 13 , 14 or 15 , then in the document Sick leave reason is selected either .

With code 09 To select the correct reason in the program, you need to look at the disability certificate for the age of the person being cared for:

If the age does not exceed 15 years, then this is caring for a child, and if it exceeds, then it is caring for a sick adult family member.

For a reason (09, 12, 13, 14, 15) Caring for a sick child you will need to fill in additional information on the tab Care for children :

For a reason (09) Caring for a sick adult family member a similar tab will be called Caring for relatives :

Dates in details Release from work from... to... are filled out based on the information in the table of the same name on the certificate of incapacity for work. The program document indicates the general period of incapacity for work:

Employee Gerankin G.G. provided a certificate of incapacity for work, which indicated the following periods of release from work:

- from 04/10/2018 to 04/16/2018;

- from 04/17/2018 to 04/22/2018.

In the document Sick leave the period of release from work is indicated from 10.04 to 22.04:

Checkbox

This means that if an employee provides or has previously provided certificates of earnings from other employers, they will be taken into account when calculating temporary disability benefits.

If you do not need to take into account certificates from other employers when calculating benefits, then the checkbox should be cleared.

There is only one case when the average earnings during work for another policyholder / policyholders should not be taken into account - this is if temporary disability or maternity benefits are assigned and paid to the insured person for all places of work ().

This procedure applies if the insured person at the time of the insured event is employed by several policyholders and was employed in the two previous calendar years. from the same insurers.

Or the second option - if the insured person at the time of the insured event is employed by several policyholders, and was employed in the two previous calendar years both these and other policyholders. With this option, the employee himself has the right to choose the order of receiving benefits: either for all places of work, or for one of his last places of work. If he chooses the order “for all places of work,” it means that the earnings of other employers do not need to be taken into account when calculating benefits.

In the working time sheet, the period of temporary incapacity for work is highlighted by a letter code B :

Calculation of temporary disability benefits in 1C ZUP 3 occurs in the document Sick leave . If two groups of users work with the program, then for the user with the profile Calculator in the document Sick leave details that are not visible to HR officers are displayed: average earnings, accrued amounts, procedure for payment of benefits:

All amounts in the document Sick leave are calculated at the input stage by the user with the HR profile, but are not displayed on the form. When a document is opened by a user with a biller profile, he immediately sees the calculated amounts; all that remains is to check them, add additional data if necessary, and approve the document by checking the box Calculation approved and carry it out.

If multi-user work is not configured in the program, then the approval flag in the document form is not displayed; it is considered that the document is approved immediately when it is submitted.

Temporary disability benefits are calculated based on the employee’s average earnings. In this case, a special algorithm for calculating average earnings is used (different from the algorithm for calculating the average for paying for vacations and business trips). The procedure for calculating average earnings for paying benefits is defined in Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity.”

The average daily earnings for calculating benefits for temporary disability are determined by dividing the amount of accrued earnings (earnings for two calendar years preceding the year of temporary disability, including during work for another policyholder) by 730.

This earnings includes all types of payments and other remuneration in favor of the insured person, which were included in the base for calculating contributions to the Social Insurance Fund.

Average earnings are taken into account for each calendar year in an amount not exceeding the maximum base for calculating insurance contributions to the Social Insurance Fund established for the corresponding calendar year.

- The maximum average daily earnings for calculating benefits in 2019 will be:

(RUB 755,000 + RUB 815,000) : 730 = RUB 2,150.68

You can view and, if necessary, adjust the data for calculating average earnings in the form, which is called up by clicking the button with the image of a green pencil:

Manual adjustments to amounts on this form will appear in bold and will only affect the calculation of that benefit, i.e. Manual adjustments are not saved for subsequent benefit calculations.

Detailed information on how average earnings were calculated can be obtained in printed form Calculation of benefits for a certificate of incapacity for work .

Example 1

Employee Gerankin G.G. I was sick from 04/10/19 to 04/22/19.

In 2017-2018, the employee worked in the organization Barbaris LLC and his income subject to insurance contributions was: for 2017 - 540,000 rubles, for 2018 - 580,000 rubles.

The calculation of average earnings is given in the form Calculation of benefits for a certificate of incapacity for work :

The employee’s earnings did not exceed the maximum base for calculating contributions to the Social Insurance Fund either in 2017 or in 2018, therefore, to calculate the average, the entire amount of income received is taken into account.

- (540,000 rub. + 580,000 rub.): 730 days = 1,534.25 rub.

Example 2

During the billing period, her income subject to insurance contributions amounted to: for 2017 - 600,000 rubles, for 2018 - 887,000 rubles.

The employee’s earnings in 2018 exceeded the maximum base for calculating contributions to the Social Insurance Fund (815,000 rubles), so for 2018 only 815,000 rubles are taken into account. For 2017, the average includes the income actually accrued to the employee:

The employee's average daily earnings were:

- (600,000 rub. + 815,000 rub.): 730 days = 1,938.36 rub.

Example 3

During the billing period, his income subject to insurance contributions amounted to: for 2017 - 1,748,234.80 rubles, for 2018 - 1,850,188.00 rubles.

The employee’s earnings exceeded the maximum base for calculating contributions to the Social Insurance Fund in both 2017 and 2018, so the calculation is made based on the maximum value of the base for contributions to the Social Insurance Fund:

The employee's average daily earnings were:

- (RUB 755,000 + RUB 815,000): 730 days = RUB 2,150.68

If the employee was in one or two previous calendar years on maternity leave and/or on maternity leave, then she can contact the employer with an application to replace the corresponding calendar years (calendar year) with previous calendar years (calendar year), if this leads to an increase in the amount of benefits (Part 1, Article 14 of the Federal Law of December 29, 2006 N 255-FZ ).

To reflect the replacement of the working year when calculating average earnings, it is necessary in the document Sick leave open form Entering data to calculate average earnings , switch Calculation period of average earnings set to position Set manually and indicate the years for which income is required to be taken into account in calculating average earnings.

Makova A.V. was temporarily disabled from April 16 to April 22, 2019, which was registered in the program using a document Sick leave . The two previous years were selected by default as the calculation years for average earnings: 2018 and 2017. However, employee Makova A.V. in 2018 I was on maternity leave and my income for 2018 was less than my income for 2016:

- 2018: RUB 215,000;

- 2017: RUB 357,525.58;

- 2016: 450,000 rub.

Therefore, the employee wrote an application to replace 2018 with 2016, in which the earnings turned out to be more.

To reflect such a replacement in the document Sick leave you need to open the calculator for calculating average earnings, check the box Set manually and change the working years sequentially: first 2017 to 2016, then 2018 to 2017.

It is worth keeping in mind that with such a replacement of working years, the income of employees, taken into account in calculating the average, will be compared with the maximum value of the FSS insurance premium base for precisely those years for which the replacement took place. In the example under consideration, this is the limit value for 2016 and 2017.

Checkbox Take into account the earnings of previous policyholders installed by default:

This means that if an employee provides or has previously provided certificates of earnings from other employers, they will be taken into account when calculating temporary disability benefits. Information about an employee’s earnings from other employers is entered into the program using the document Help for calculating benefits ().

Document Help for calculating benefits can be entered either directly from the calculator for calculating average earnings (button Add help from previous places of work ):

Another input option is in the document journal Help for calculating benefits (Salary – See also – Certificates for calculating benefits). The document should indicate the employee, the previous employer, and in the tabular section for each accounting year, fill in information about earnings and excluded days - days of illness, child care, etc. (excluded days will be taken into account when calculating average earnings for maternity leave, benefits for child care).

Employee Kirsanov K.K. has been working for Barbaris LLC since December 2018. In April 2019, an employee fell ill. To calculate the benefit, along with a certificate of temporary disability, he submitted a certificate of earnings from his previous place of work, Trading House LLC, for 2017-2018.

Data from the certificate was entered into the document Help for calculating benefits :

When calculating average earnings in the document Sick leave The earnings for December 2018 received from the current employer are taken into account, as well as the employee’s earnings for 2017-2018 received in the organization Trading House LLC:

The employee's average daily earnings were:

- (650,000 rub.<заработок за 2017-2018 г. у предыдущего работодателя>+ 49,270 rub.<заработок за декабрь 2017 у текущего работодателя>): 730 days = 957.90 rub.

If the average earnings are less than [Minimum wage as of the start date of temporary disability] x / 730, then the benefit will be calculated based on the minimum average earnings determined on the basis of the minimum wage.

In this case, in the props Average earnings the actual average calculated from the employee’s earnings is displayed, but there is also a note that the benefit is calculated using the average daily earnings from the minimum wage:

The calculation of the minimum average earnings is given in paragraph 3 of the printed form Calculation of benefits for a certificate of incapacity for work :

The insurance period and percentage of benefit payment are reflected on the tab Payment document Sick leave .

The insurance period is filled out on the basis of information about the insurance period entered into the program when hiring an employee or directly in the employee’s card using the link Labor activity .

Experience determines filling in the details Benefit payment percentage .

The payment percentage is determined as follows:

It is also worth considering that if we are talking about sick leave to care for a child/sick adult family member, then for the case of outpatient treatment for the first 10 days the percentage of payment is determined depending on the length of the insurance period, and for subsequent days the percentage does not depend on the length of service - and is 50% of average earnings.

Employee Gerankin G.G. was hired in 2017, his insurance experience as of the date of hire was 5 years and 3 months:

As of the date of onset of disability (04/10/2019), the employee’s insurance length was a full 7 years and 5 months and 27 days.

Experience was automatically filled in the document Sick leave . Based on the length of service, the percentage of payment was determined - 80% , because experience was more than 5 and less than 8 years:

The benefit is calculated on the basis of information about the amount of the employee’s daily benefit and the period of incapacity (Part 5, Article 14 of Federal Law No. 255-FZ):

- Amount of benefit = Amount of daily benefit * Number of calendar days of temporary disability

Sick leave benefits are financed as follows:

In the 1C ZUP 8.3 program, benefits at the expense of the employer’s funds are accrued according to the type of calculation, and at the expense of the Social Insurance Fund - according to the type of calculation Sick leave .

Example 1

The employee’s average daily earnings for calculating benefits amounted to RUB 1,534.25.

The percentage of benefit payment based on the insurance period is 80%

The employee was sick for 13 calendar days, 3 of which will be paid at the expense of the employer, and the remaining 10 at the expense of the Social Insurance Fund:

- RUB 1,534.25 x 80% = 1227.40 rub.

- the benefit at the expense of the employer will be 3 days x 1,227.40 rubles. = 3,682.20 rub.

- benefit from the Social Insurance Fund – 10 days x 1,227.40 rubles. = 12,274.00 rub.

Example 2

Employee Arbuzova A.A. was temporarily disabled from May 7 to May 15 due to quarantine.

The employee’s average daily earnings for calculating benefits amounted to 1,938.36 rubles.

The percentage of payment of benefits, determined based on the insurance period, was 80%

For the cause of disability 03 (Quarantine) all days are paid at the expense of the Social Insurance Fund:

To calculate the benefit, the amount of the daily benefit in rubles and kopecks is first determined:

- RUB 1,938.36 x 80% = RUB 1,550.69

The benefit amount is then calculated:

- the benefit from the Social Insurance Fund will be 9 days x 1,550.69 rubles. = 13,956.21 rub.

Example 3

The employee’s average daily earnings for calculating benefits amounted to RUB 2,150.68.

The percentage of benefit payment determined based on the insurance period is 60%

The employee was sick for 3 calendar days; accordingly, all these days will be paid at the expense of the employer:

To calculate the benefit, the amount of the daily benefit in rubles and kopecks is first determined:

- RUB 2,150.68 x 60% = 1,290.41 rub.

The benefit amount is then calculated:

- the benefit at the expense of the employer will be 3 days x 1,290.41 rubles. = 3,871.23 rub.

The determination of the “first three days” of disability, which are paid by the employer, is made taking into account the fact that this sick leave may be a continuation of another. In addition, continued sick leave is calculated based on the same average earnings as the initial sick leave.

Employee Makova A.V. I was sick from April 16 to April 30. The employee went to work and presented two certificates of incapacity for work: the first - for the period from 16.04 to 22.04, the second - which is a continuation of the first - for the period from 23.04 to 30.04.

In this case, the calculation of the first three days of benefits at the expense of the employer will occur in the first document Sick leave (for the period from 16.04 to 22.04).

In the document Sick leave for the period from April 23 to April 30, which is a continuation, the entire benefit period will be calculated at the expense of the Social Insurance Fund:

This happens because the checkbox is selected in the document Is a continuation of the certificate of incapacity for work and the source document is indicated. Based on this in the tab Payment as Start dates of incapacity The start date is automatically selected from the primary document (04/16):

On the tab Payment document Sick leave Additional initial data can be specified that can affect the calculation of benefits:

or in the line the reason for disability, the code “021” is indicated as an additional code (illness or injury resulting from alcohol, drug, toxic intoxication or actions related to such intoxication):

The benefit from the date of violation of the regime will be limited above the minimum wage.

If the organization is located in a region where a pilot Social Insurance Fund project is operating, providing for direct payments of benefits to employees, then in the settings of the organization’s accounting policy (directory Organizations - Accounting Policies and other settings tab) the appropriate settings must be made. You should select from the predefined list the option that corresponds to the date the region entered the pilot project:

In this case, in the document Sick leave on the tab Accrued (details) Only that part of the benefit that is paid at the expense of the employer will be calculated (for the first three days):

Another tab will also become available in the document. FSS pilot project , where you will be able to fill in the data for the register of information transferred to the Social Insurance Fund and enter the employee’s application for payment of benefits:

In the document Sick leave there are props Payment date which needs to be filled in. Entering the details is required since it is on this date that the calculated personal income tax will be registered.

However, even if the actual payment does not take place on this planned date, the date of receipt of income for personal income tax from sick leave will be specified directly in the document Statement..., with which the payment is recorded.

Therefore, go back and correct the payment date in the document Sick leave not necessary.

By default, benefits at the expense of the employer are reflected in the document by type of transaction Insurance costs at the expense of the employer and refer to the same method of reflection as the employee’s main salary, unless another method is specified in the accrual type settings Sick leave at the expense of the employer :

Accruals for other benefits in the document Reflection of salaries in accounting are recorded by type of transaction Social Insurance Insurance Costs (for accruals by type of calculation Sick leave), or Insurance costs for the Social Insurance Fund (for accrual types Sick leave for occupational illness And Sick leave for injury at work ), which, after synchronization with 1C Accounting, provide the corresponding postings. Reflection methods for rows with these types of operations are not filled in:

In 1C ZUP 3, it is possible to account for accruals by financing items. This feature can be enabled in the payroll settings ( Settings – Payroll – Use accounting by financing items).

If this functionality is enabled, then in the settings of the calculation type Sick leave at the expense of the employer on the tab Taxes, contributions, accounting it becomes possible to check the box The financing item is determined based on average earnings . As a result, the amount accrued for this type of calculation will be distributed between financing items in proportion to how the income included in the average was distributed among financing items:

Employee Nesterova S.P. In May 2019, sick leave is accrued. Average earnings take into account income for 2018. During this period, the employee’s income was distributed between financing items A and B, and it was from this income that the average was calculated.

You can see how income was distributed in the document’s average earnings calculator Sick leave . To do this, right-click on the cell with data on the income of a particular month and select Read more… :

From employee Nesterova S.P. From January to May, income was distributed as follows:

- 60,000 rub. for Funding Article A,

- 6,000 rub. on Funding Article B.

From June to December respectively:

- 62,000 rub.,

- 6,200 rub.

In total for 2018, income was distributed as follows:

1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Let's consider accrual for sick leave in 1C 8.3. Let's create a new document. We indicate the reason for the disability by selecting from the list:

The percentage of payment based on length of service is calculated by the 1C 8.3 program from the data in the database. Entering information about work experience from your previous job is not yet possible in the configuration; the payment percentage can be corrected manually:

In the 1C 8.3 Accounting program you can view and edit, if necessary, the calculation of average earnings. To do this, click on the pencil:

Also in the 1C Accounting 8.3 configuration, it is possible to replace accounting years. If we change years, it is important not to forget to recalculate the allowance:

Information for calculating the average can be viewed summarized by year or broken down by month. If any data needs to be corrected, this can be done in the form:

From the document you can print the calculation of average earnings:

Calculation of average earnings in 1C 8.3:

On the Additional tab, you can specify a benefit restriction, if any. As well as applying benefits by choosing from the list:

On the Accrued tab we see the calculation of sick leave: three days at the expense of the employer and the rest at the expense of the Social Insurance Fund:

Please note the payment date:

Using the Sick Leave document, you can not only calculate the payment of benefits. Program 1C 8.3 Accounting calculates the salary taking into account the absence of the employee:

How to enter sick leave in 1C 8.3 Accounting (3.0), how to correctly calculate sick leave is discussed in the module. For more information about the course, watch our video:

Confirmation of an employee’s temporary incapacity for work is a certificate of temporary incapacity for work issued by a medical institution. An employee can, at his choice, either receive a certificate of incapacity for work in paper form (on a blue form) or issue an electronic “sick leave”, in this case, the medical institution will tell him only the number of the certificate of incapacity for work, from which the employer can subsequently obtain all the information necessary to calculate benefits . To be able to issue electronic sick leave, the employing organization must be connected to the information interaction system with the Social Insurance Fund. Let's look at how to register a paper or electronic certificate of incapacity in the program.

The certificate of incapacity for work is registered in the 1C: ZUP 3 program using the document Sick leave (Personnel – All employee absences):

If two groups of users work with the program: HR specialists and payroll accountants, then it is assumed that the document Sick leave entered by a user with a profile Personnel officer, indicating in it the employee and the data from the certificate of incapacity for work, and then the user with the profile Calculator– calculates temporary disability benefits and approves the document. This publication discusses working on behalf of a user with a HR profile.

In the document Sick leave , you must fill in the details correctly Month And date . date is the date of registration of sick leave in the program, and Month– accrual month in which the employee will be accrued benefits according to the document Sick leave .

Example 1

Example 2

In props LN number the number of the certificate of incapacity for work is indicated.

If an employee has submitted a paper “sick leave”, the number will be located in the upper right corner of the certificate of incapacity for work:

If an employee has been issued an electronic “sick leave”, the medical institution will inform him of the number of the certificate of incapacity for work. The number can also be found in the personal account of the insured person or in the personal account of the employer on the FSS website. Using the sick leave number, you can download all the electronic sick leave data into the 1C program automatically - just click on the button Get data from the FSS .

To calculate temporary disability benefits, you need to know the employee's insurance record. Information about the insurance period calculated as of the date of the onset of temporary disability will need to be indicated on the paper “sick leave” in the section To be completed by the employer .

Usually the initial insurance period, i.e. The length of service calculated as of the date of admission is entered into the program when the employee is hired, and in the document Sick leave The insurance period is automatically calculated as of the start date of temporary disability. In this case, no additional actions are required from the user.

If the insurance period for an employee is not entered in the program, then it must be entered for the correct calculation of benefits. In this case, in the form of a document Sick leave the inscription is displayed The length of service is not completed, benefits may be calculated incorrectly :

You should click on this inscription and enter the insurance period.

If the field on the certificate of incapacity is filled in Continuation of certificate of incapacity for work No. , this means that this sick leave is a continuation of another.

In this case, in the document Sick leave in the program you need to check the box and select the document Sick leave , of which this document is a continuation.

Example

In this case, first the document is entered into 1C Sick leave for the period from 16.04 to 20.04:

Then the second document is entered Sick leave , in which the checkbox is checked Is a continuation of the certificate of incapacity for work and a link to the first one is indicated Sick leave:

In props Cause of disability the reason for the disability is indicated based on the code filled in the corresponding cells of the certificate of incapacity for work:

A breakdown of the cause of disability codes is presented on the back of the form:

Example

In the document Sick leave based on this, the cause of disability is indicated - (01, 02, 10, 11) Illness or injury (other than work-related injuries) :

If one of the following codes is indicated on the certificate of incapacity for work: 09 , 12 , 13 , 14 or 15 , then in the document Sick leave reason is selected or .

With code 09 To select the correct reason in the program, you need to look at the disability certificate for the age of the person being cared for:

If the age does not exceed 15 years, then this is caring for a child, and if it exceeds, then it is caring for a sick adult family member.

For a reason (09, 12, 13, 14, 15) Caring for a sick child you will need to fill in additional information on the tab Care for children :

For a reason (09) Caring for a sick adult family member a similar tab will be called Caring for relatives :

Details on how sick leave is registered and benefits are calculated in the case of caring for children or relatives are discussed in the publication Sick leave for care - registration and calculation in 1C.

Dates in details Release from work from... to... are filled out based on the information in the table of the same name on the certificate of incapacity for work. The program document indicates the total period of incapacity for work.

In the document Sick leave the period of release from work is indicated from 10.04 to 20.04:

Checkbox Take into account the earnings of previous policyholders installed by default:

This means that if an employee provides or previously provided certificates of earnings from other employers, and they were entered into the program, then the earnings from the certificates will be taken into account when calculating temporary disability benefits.

If you do not need to take into account certificates from other employers when calculating benefits, then the checkbox should be cleared.

In the working time sheet, the period of temporary incapacity for work is reflected by a letter code B :

Sick leave is calculated from the certificate of incapacity for work provided by the employee. The amount of the benefit depends on the nature of the disability, as well as the length of insurance coverage. Let's look at how the insurance period is reflected in the calculation of benefits:

Sick leave is calculated based on the average earnings of the insured employee for the previous two years. At the same time, the calendar years for which sick leave is calculated for the employee can be replaced. These are situations where the employee used maternity leave or maternity leave in one or two of these calendar years. According to the employee's application, one or both years are replaced if the replacement entails an increase in the amount of the benefit.

Let's look at step by step how to process sick leave in 1C ZUP.

If at the time of calculating the advance or salary the employee is absent, then in 1C 8.3 ZUP it is necessary to register a failure to appear for an unknown reason, so that the salary is not accrued for the period of absence.

To be able to register an employee’s absence, you need to check the settings of the 1C program. Menu item Settings - select Payroll - next Setting up the composition of accruals and deductions - next Absence accounting - check Absenteeism and no-shows:

Failure to appear is registered using the document Absenteeism, failure to appear. The document can be entered both in the personnel menu and in the Salary section:

From our example, the employee fell ill in April from 11 to 22:

For each month of no-show/absenteeism, if the no-show continues into the next month, it is necessary to enter a new document in 1C, that is, separately for May, for June, etc.

After the employee has provided sick leave, we enter the Sick Leave document to calculate benefits. The document is a personnel and payroll document. It can be entered from the Personnel section:

or using the Payroll section:

Let's create a new document. If the work experience has not been completed previously, the program will pay attention to this fact:

If you go to this field, you can indicate the length of service directly in the document:

We indicate the nature of the disability from the sick leave certificate and the date of our sick leave. The accrual month in our case is May, that is, this is the month that will be displayed on the employee’s payslip. Checking the payment:

Checking sick leave accrual:

Absence from work for an unknown reason is reversed on the Recalculation of the previous period tab:

The date of payment for sick leave is important for personal income tax accounting. Non-salary income is recorded based on the date of payment. You can choose the payment method - in advance, with salary, or by interpayment. We take sick leave:

The peculiarity of these sick leaves is that payment for outpatient treatment is carried out in the first 10 calendar days in accordance with the length of service, and then in the amount of 50% of average earnings. If treatment takes place in a hospital, then taking into account the insurance period.

There are also calculation features in 1C ZUP that depend on the age of the child. Selecting an option for calculating sick leave for care in the Sick Leave document on the Child Care tab:

The 1C 8.3 ZUP program also tracks from what day payment will be made in the amount of 50%:

If we pay for maternity leave, benefits for work injuries or occupational diseases, then this is 100% sick pay and does not take into account length of service:

Also, if a dismissed employee provided a certificate of incapacity for work within 30 calendar days from the date of dismissal, and has not yet found a new job, then this payment is in the amount of 60% of the calculated average earnings.

In 1C ZUP, when calculating the average earnings of an employee, taking into account the earnings of previous policyholders, it is necessary that the checkbox “Take into account the earnings of previous policyholders” is checked in the document:

Where in 1C ZUP 8.3 can I enter earnings from previous policyholders? You need to go to the Main tab and click on the Change calculation of average earnings button to fill in the data:

Or from the Salary section - See also - Certificates for calculating benefits:

Average earnings are determined by the 1C ZUP 3.1 program automatically based on data on how much was included in the final base for calculating contributions in previous years. Average earnings are determined for each calendar year in an amount not exceeding the maximum base for calculating insurance contributions to the Social Insurance Fund established for that year.

The average daily income for calculating benefits is calculated by dividing accrued earnings by 730. For maternity benefits, earnings are divided by the sum of calendar days of the two previous years minus excluded periods (sick leave, maternity leave, maternity leave, periods of release from work with full or partial retention of wages, if insurance premiums were not paid on wages at that time).

You can view a printed calculation form. Printed forms Calculation of average earnings and Detailed calculation are used by the accountant to check the calculation and data, and the form Calculation of benefits for a certificate of incapacity for work is an “official” calculation, we apply it to sick leave:

Funding for sick leave benefits depends on the nature of the disability. If this is an illness or injury (other than work-related), then the first three days are paid by the policyholder. Subsequent days are paid at the expense of the Social Insurance Fund. In other cases, payment is made at the expense of the Social Insurance Fund from the first day. In the 1C ZUP program, this division is visible in two types of calculation: Sick leave and Payment for sick leave at the expense of the employer:

Hello, dear blog readers. I have to prepare this material with a slight fever and an unpleasant cough, so today we’ll talk about reflection temporary disability benefits in the 1C Salary and Personnel Management program. There is a specialized document for this purpose -. By the way, recently a separate document for calculating sick leave appeared in the 1C Enterprise Accounting configuration. You can read about this in the article How to calculate sick leave in 1C Enterprise Accounting 3.0.

Well, in today’s publication we will look at the features of working with a document "Sick leave accrual" in the configuration of ZUP 2.5 and the general theoretical basis for calculating payments for sick leave. In this article I will also touch on a number of topics directly related to the calculation of sick leave:

✅

✅

To begin with, I would like to highlight basic moments that you need to know and remember when calculating payments for temporary disability:

Notes:

Calculation features when an employee is employed by several employers:

Finally, the most interesting thing in theory is procedure for calculating temporary disability benefits. So, let's look:

✅

✅ CHECKLIST for checking payroll calculations in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll calculation in 1C ZUP 3.1

Step-by-step instructions for beginners:

So, the settlement document "Accrual for sick leave" must be entered after the employee submits a certificate of incapacity for work to the accounting department. If at the time of calculation of wages the employee is on sick leave and has not yet provided a certificate of incapacity for work, then the calculator must use another document "Absenteeism from the organization". Thus, when calculating the salary, sick days will be superseded, and the salary will be calculated in proportion to the days worked. In the example, we will consider just such a situation using these two documents.

Let an employee of Sidorovo be sick from March 28 to April 14, 2014. Around April 8 or 9, the accountant begins to calculate the salary for March 2014.

I would like to note right away that this should be done before calculating the main part of the salary with a document “Payroll for employees of the organization.”

In the document "Absenteeism in the organization" you should select the accrual month March 2014. In the tabular part of the document, add a line and select employee Sidorova. As the type of absenteeism we choose "Unexplained Absence" since officially we do not yet have documents confirming the disease. Well, we will indicate the period from March 28 to April 14. The program will offer to split the lines in the document monthly and you should agree with this proposal.

After this, we will calculate the planned accruals using the document "Payroll". Read more about calculating planned accruals in the article. The salary will be calculated in proportion to the days worked, from which days of absence were excluded. See picture.

On April 14, the employee decides to stop being sick and returns to work with a certificate of incapacity for work, which he brings to the accounting department. After this, the calculator already has every right to use the document "Sick leave accrual." This document can be accessed from the tab "Payroll calculation" program desktop (link in the middle column).

The following fields must be filled in the document:

✅ Seminar “Lifehacks for 1C ZUP 3.1”

Analysis of 15 life hacks for accounting in 1C ZUP 3.1:

✅ CHECKLIST for checking payroll calculations in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll calculation in 1C ZUP 3.1

Step-by-step instructions for beginners:

I have already noted earlier that one of the parameters that directly affects the calculation of benefits is length of service. Before calculating sick leave, you must enter information about the employee’s length of service. To do this, you need to open Sidorov in the “Employees” directory and follow the link “in more detail about the individual” to go to the individual. face. And open the form there by clicking on the button "Labor activity". In this form, you need to add a line in the “General Experience” tabular section. To do this, right-click on the area of this tabular part and in the context menu that opens, click on “Add”. Set the “Type of experience” “Insurance period for payment of sick leave” and indicate the date from which to count the length of service (for example, the date of admission to this organization), and the number of years, months and days of service that the employee had on this date.

The document will be calculated according to the minimum wage, since the database does not contain information about the employee’s earnings in the previous two calendar years. Calculated as follows:

2,629.44 = 5,554 (minimum wage) * 24 (2 years) / 730 * 18 (days of disability) * 80% (percentage depending on length of service)

After calculating the document, a message was displayed “No income data was found for the specified accounting years!”

|

This message appeared because the employee was hired by this organization in 2014, and in 2013 and 2012 he worked in another organization. In order to enter information about earnings, you should use a specialized document “Certificates of other policyholders on earnings”. The link to the document is on the tab "Payroll calculation" desktop program in the section “see. Also". In the document you must indicate the employee and enter the previous organization, and in the tabular section indicate earnings for 2012 and 2013.

It is worth noting that the employee’s salary for these two years was recorded in this program, so of course there is no need to enter this document. The salary will be taken into account automatically.

Don't forget to post the document. After this, we will return to the sick leave calculation document. Check the box in the document “take into account the checkbox of previous policyholders” and click “Calculate” again.

7,574.76 = 384,000 (income for 2 years) / 730 * 18 (days of disability) * 0.8 (percentage depending on length of service)

Document "Sick leave accrual" also contains another tab “Calculation of sick leave”, which contains information about calculating the average. In fact, with automatic calculation there is no need to edit the data on this tab. But for general development, let’s see what it is.

Pay attention to the red lines in this tabular section. These lines cancel the information entered by the document "Absenteeism in Organizations."

Now let’s select the “Personal Income Tax” tab, where you can see the amounts of calculated personal income tax.

And one more tab “Calculation of average earnings”. On it we will see the same information about earnings that we entered into the document “Certificates of other policyholders on earnings.”

The “Sick Leave Accrual” document contains a number of printed forms. You can open them by clicking the “Print” button located in the lower right corner of the form. The most commonly used form “Calculation of average earnings since 2011.”

That's all for today! Stay safe and see you again on the blog pages. New interesting materials will be coming soon.

To be the first to know about new publications, subscribe to my blog updates: